Navigating the world of investments can often feel like deciphering a complex code. get more info One concept that frequently sparks confusion is the electronic trading account. A demat account, in essence, is your digital vault for securities like stocks and bonds. Think of it as a modern-day equivalent of a physical share certificate, but held securely in electronic realm. This article aims to shed light on the workings of demat accounts, empowering you with the knowledge to confidently participate in the digital investment landscape.

Opening a demat account is a relatively straightforward process. You'll typically need to provide identification verification such as your PAN card and Aadhaar number. Once approved, you can begin trading in a wide range of securities through digital marketplaces. The benefits of having a demat account are manifold, including streamlined operations. It allows for instantaneous monitoring of your portfolio value and enables you to trade effortlessly.

- Recognizing the merits of a demat account is crucial for any investor looking to navigate the digital realm of finance.

- By securing your digital holdings, you unlock a world of investment possibilities and pave the way for a efficient trading experience.

Gaining Financial Freedom: The Power of a Demat Account

A trading account is your gateway to participating the financial markets. It allows you to purchase and trade shares of companies electronically, removing the need for physical share certificates. This streamlining unlocks a world of potential for people to grow wealth and achieve financial freedom.

Utilizing the power of a demat account, you can spread your investments across different markets, mitigating risk and maximizing returns. You can also access advanced trading tools and networks to place trades with efficiency.

Gain Access Your Demat Account Today: A Step-by-Step Guide

Ready to dive into the world of investing? Establishing a demat account is your primary step. This straightforward process allows you to acquire shares in public companies, participate in the stock market, and potentially grow your wealth over time. Here's a step-by-step guide to make opening a demat account a breeze.

- Research various demat account providers to discover one that matches your needs and preferences.

- Provide an online application form, ensuring you input accurate and up-to-date personal information.

- Submit the necessary documents, such as proof of identity, address, and income verification.

- Scrutinize the terms and conditions carefully before submitting to the account opening process.

- Get confirmation from the demat account provider once your application has been reviewed.

Congratulations! You have now efficiently opened a demat account. Begin your investing journey with confidence, and remember to research the market before making any investment decisions.

Demat Account Essentials: What You Need to Know Before You Begin

Embarking on your investment journey requires opening a Demat account. This crucial step allows you to trade securities electronically, simplifying the process and providing clarity. Before you dive in, it's essential to familiarize yourself with some key aspects of Demat accounts. Firstly, choose a reputable Depository Participant (DP) that aligns with your needs and offers favorable rates. Next, thoroughly review the terms of the DP, paying special attention to account maintenance charges, transaction fees, and other pertinent details.

- Additionally, ensure you have the necessary documents ready, such as your PAN card, Aadhaar card, and proof of address.

- Lastly, keep in mind that maintaining your Demat account requires consistent monitoring.

By taking the time to learn these essentials, you can smoothly navigate the world of Demat accounts and begin your investment journey with confidence.

Venturing Into Stocks: How to Open a Demat Account

The stock market can seem like a mysterious world, but opening a Demat account is the first stride towards exploring it. A Demat account, or Depository Participant service, allows you to buy and dispose shares of publicly listed companies electronically. To get started, you'll need to select a reputable financial institution.

- Research different brokers based on their fees, features, and customer service.

- Submit an application form with your personal details.

- Upload the required evidence such as proof of residence and income.

- Complete the necessary expenses associated with opening the account.

Once your application is processed, you'll receive your Demat account details. Now you can begin trading in the exciting world of stocks!

Unlocking Your Investment Potential

Embark on your investment journey with a Demat account, the essential tool for engaging the world of securities. A Demat account, short for Depository Participant platform, provides you safe electronic holding of your shares. Navigate the intricacies of investing with ease, as a Demat account allows for frictionless exchanges. Initiate your investment path today and unlock a world of financial opportunities.

- Advantage from real-time trade execution.

- Enhance your investment portfolio with electronic access.

- Explore a wide range of securities through your account.

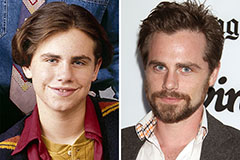

Rider Strong Then & Now!

Rider Strong Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Michael C. Maronna Then & Now!

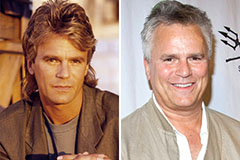

Michael C. Maronna Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!